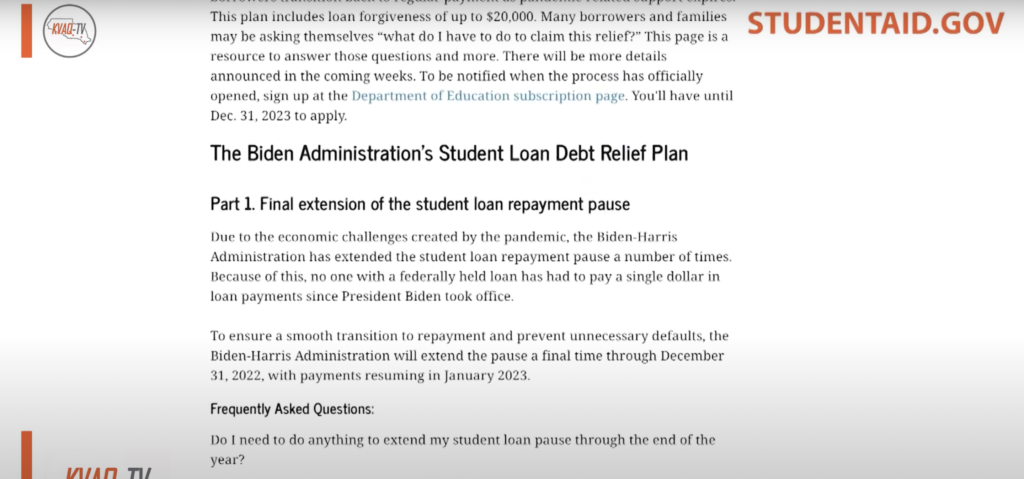

EDINBURG – The Biden Administration has issued a three-part plan that will help aid middle and working-class student loan borrowers, forgiving up to $20,000 worth of student debt.

The Administration has also extended the repayment pause one final time which will not require payment until January of 2023.

“With what the Biden administration just submitted; they’re going to create another repayment plan to help make student loans more affordable,” said Felipe Olivarez, assistant director of financial aid at UTRGV.

To be eligible for aid individuals must receive an annual income below $125,000 and $250,000 for married couples or head of household.

“For those students who receive Pell grant as an undergraduate student, then they can potentially qualify for up to $20,000 loan forgiveness. For those students that did not receive the Pell as an undergrad, then they can qualify for up to $10,000 loan forgiveness,” said Olivarez.

Since the announcement, the Student Debt Relief Plan has raised questions about the potential debt in the economy.

“An argument that is made is that this loan forgiveness can worsen inflation and that’s a valid argument. But I think that what’s more important here is that the cost of college has rapidly increased, so any kind of loan forgiveness has many long-term benefits,” said Gautam Hazarika, economics associate professor at UTRGV.

The deadline to apply for student debt forgiveness is December 31st, 2022, but it is recommended to apply by November 15th to receive the relief before the payment pause expires.